The investment teaching companies that Triblexbit App connects people with are run like colleges and other institutions of learning. These institutions equip people with knowledge, helping them to become learned and financially disciplined.

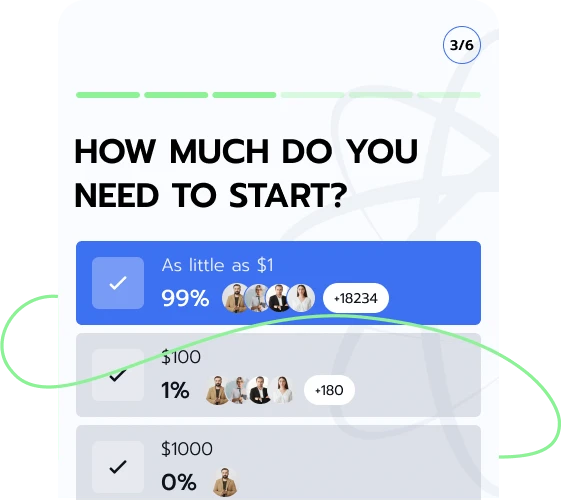

To connect with investment teachers, people only have to register on Triblexbit App by filling out the registration form with their names, email addresses, and phone numbers. After this, each person will receive a call from their matched companies on the next steps.

Triblexbit App gives more exposure to investment education through its partnership with investment education firms worldwide. These firms shed light on the investment landscape, and learners can acquire investment knowledge through this partnership. Connect with one of Triblexbit App’s partners by signing up.

With Triblexbit App, learners are not boxed or limited in their choice of investment course. Investment teachers only offer advice on choosing courses when necessary.

The advice helps those with uncertainties decide which course suits their personalities, jobs, and careers. Register on Triblexbit App to connect with an investment teaching company.

Learners get to comprehend their lessons fully and grasp transferred skills under their teachers’ supervision.

People build their skills through practical learning, doing assignments, and taking tests and exams. Register to connect with an investment education company on Triblexbit App to be equipped with the necessary skills.

Triblexbit App only connects people to personalized training firms. These firms will assess each user to craft a curriculum suitable for them. Register on Triblexbit App to get started.

Triblexbit App’s services are offered free of charge. The website exists to make investment education more accessible. Offering free access aligns very much with that goal. Sign up on Triblexbit App to move toward financial enlightenment.

Triblexbit App has partnered with investment education firms that provide services in multiple languages. Sign up on Triblexbit App to connect with an investment education firm.

An investor training firm teaches people how to become informed investors, create investment plans and portfolios, exchange assets in marketplaces, and assess risks. These firms help people acquire certain financial/investment skills. Learn more from investment teachers by registering on Triblexbit App.

It is an asset held for a period and exchanged in a marketplace to try for possible gains. While investors desire to make positive returns, it is not always the case because of risks. Risks could be generic, that is, affecting the investment market. It could also be specific to a particular business or company. Triblexbit App outlines a few ways investors may mitigate risks:

Individual and institutional investors conduct thorough research before investing in an asset or company. Before investing in a company, investors determine its viability using certain ratios. These ratios include return on assets, return on equity, cash flow, gross, net gains, pretax, and operating margins. Learn more about due diligence by signing up on Triblexbit App.

Investors may also mitigate risks using their risk tolerance. An investor may have moderate, conservative, or aggressive tolerance. Each investor’s risk tolerance will determine how much capital loss they can bear. Someone with an aggressive tolerance may bear a high risk of capital loss, while a moderately risk-tolerant cannot. Connect with investment teachers on Triblexbit App to learn more.

Asset Allocation

It is investing in different asset classes. Register on Triblexbit App to learn how investors may use asset allocation to mitigate risks.

Liquidity

Investors keep enough liquid assets to capitalize on positive market rates. To learn more, register on Triblexbit App.

Diversification

Diversification involves investing in different assets in several asset classes.

If an investor chooses to invest in five asset classes, they can invest in three assets in each class. For example, if an investor chooses to invest in bonds (asset class), they can further invest in municipal, agency, and government bonds. For more information, register on Triblexbit App.

An investor rebalances by returning the value of a portfolio’s asset allocations to the level initially defined by their investment plan. The levels are usually planned to match an investor’s risk tolerance. Rebalancing techniques include smart-beta, calendar, constant portfolio insurance, and constant-mix rebalancing. Rebalancing can change as an investor’s financial goals and needs change, but it can also increase costs. Get more details about rebalancing by signing up on Triblexbit App.

Here, CF is cash flow in the period, r is the interest or discount rate, and n is the duration. The DCF formula is used to value a bond, the pros of a cost-saving initiative in a company, an income-producing property, a business, a project, and company shares.

Also, the DCF formula shows that if an investor pays less than the DCF value, their return rate may be higher than the discount rate. If an investor pays more than the DCF value, their return rate will be lower than the return rate. Register on Triblexbit App to learn more.

These show a company’s costs and income and forecast its financial performance. Commercial and investment banking use financial models for due diligence and business valuations, while other institutions use them for research and portfolio management. Generally, financial models help business leaders to plan budget and resource allocation, manage risks, gain stakeholder financial insights, and identify opportunities.

The challenges of this model include rigidity, complex mathematical formulas, biased assumptions, incomplete data capture, and the possibility of error. The different financial models are budget, merger, three-statement, leveraged buyout, option pricing, sum of the parts, discounted cash flow, forecasting, initial public offering (IPO), and consolidation models. Triblexbit App analyzes some of them below:

It works for financial planning and analysis. People can plan the budget for future years. The model forecasts cash flow, growth, expenses, and revenue for up to five years. Get more information about the budget model from investment teachers by registering on Triblexbit App.

It evaluates a merger’s or acquisition’s formation or dilution. It shows whether the acquisition of a smaller company is financially favorable for a larger company. The model is often used in investment banking and corporate development. Register on Triblexbit App to learn more.

This model links a company’s balance sheet and income and cash flow statements. Combining these three inputs with risks, drivers, and assumptions can help to model business and stock valuation, cash flow forecasts, and project-related expenses. Sign up on Triblexbit App to learn more.

The model evaluates if a company would be fitting for a leveraged buyout. The model estimates a company’s future performance and values it by analyzing its cash flow, revenue growth, and debt payments. Connect with investment education firms on Triblexbit App to learn more.

Types of cash flow are free cash flow to equity (FCFE), free cash flow to the firm (FCFF), net change in cash, and cash from operating activities. FCFE is the cash available after reinvesting into a business, while FCFF measures and assumes a company has no debt. Learn about others from investment tutors by registering on Triblexbit App.

A par bond trades at its face value. Here, an investor pays the same amount for a bond whose coupon rate is the same as the market yield. Register on Triblexbit App to learn more.

A bond with a discount coupon rate requires investors to pay a lower price because it offers a lower coupon rate than the market yield. Connect with investment tutors on Triblexbit App for detailed information.

The meaning of income might differ based on contexts like investment, economic analysis, accounting, and taxation. Income generally signifies the returns from exchanging a product or labor. Types of income are annuities, capital gains, royalties, rental income, and wages. Register on Triblexbit App to learn more from investment education companies.

Investors may use savings accounts to mitigate idle cash because of their liquidity. The accounts also allow a fixed number of free or low-fee transactions. Register on Triblexbit App to learn more.

People could use their idle cash to buy equities or debts. These assets can be liquidated easily and may have high returns but are highly risky. Want to learn more? Register on Triblexbit App.

These are the same as savings accounts but only have higher interest rates. The liquidity of high-interest savings accounts is somewhat reduced because of the high interest rates. Learn more by signing up on Triblexbit App.

Businesses may use their idle cash by buying long and short-term assets and inventories to support their daily operations and expand. Sign up on Triblexbit App for more details.

A checking account is a highly liquid bank account that allows a flexible withdrawal. Some checking accounts may pay low interest rates, while others do not pay at all. Sign up on Triblexbit App to learn more about checking accounts.

Funds are locked in term deposits for a period. The longer the money stays locked, the higher the possible interest rate. Get further details on term deposits by signing up on Triblexbit App.

Triblexbit App connects people with investment education firms so they can learn extensively. Sign up on Triblexbit App to connect with investment education firms.

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |